The 3 School of Thoughts

Macroeconomists have different views about how the market operates.

School of Thought: a particular idea or way of thinking that a group strongly believes in, and takes it into their practices.

We are going to investigate three different macroeconomic school of thoughts and see how each macroeconomist views them.

The three school of thoughts are:

- Classical School of Thought

- Keynesian School of Thought

- Monetarist School of Thought

Classical School of Thought

The word “classical” comes from a group of economists who produced this theory, whose names were Adam Smith, John Stuart Mill, and David Ricardo.

For the classical school of thought, the idea is that the economy will always goes back to full employment (real GDP = potential GDP) because of an automatic self-regulated mechanism.

In other words, we always have

But if real GDP = potential GDP, then why does real GDP fluctuate around potential GDP, creating this business cycle, rather than being equal to it all the time?

It is due to disturbances from an uneven pace in technological advances.

In fact, technological changes play a big role in the aggregate demand and aggregate supply.

Aggregate Demand: The following types of technological changes can shift aggregate demand.

- Productivity of capital: when productivity increases, firms increase their expenditures on equipment and tools, so increases aggregate demand.

- Lengthening lifespan of capital: when equipment or tools last longer, there is a low demand for new capital. Therefore, this decreases aggregate demand.

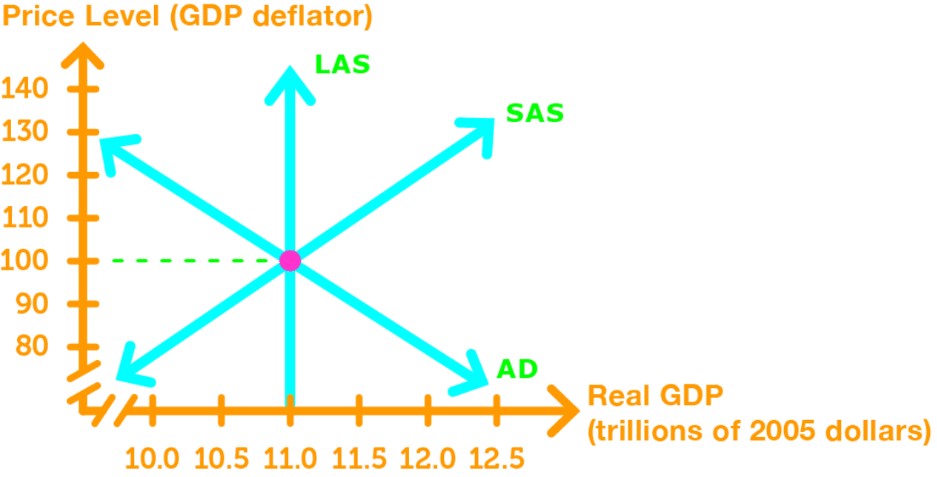

Short-run Aggregate Supply: The short-run aggregate supply is very flexible. Whether the money wage rate is too low or too high, it will eventually adjust back to equilibrium so that real GDP = potential GDP.

Long-Run Aggregate Supply: This supply curve can change depending on what happens to potential GDP, which is also influenced by technological change.

Technological change can grow at a rapid or slow pace.

- Rapid Pace: a rapid pace of technological change increases potential GDP quickly, causing real GDP to also increase.

- Slow Pace: a slow pace of technological change slows the growth rate of potential GDP, causing real GDP to increase slowly as well.

Policy: The policy for the classical school of thought says that the market works mostly efficiently when it is left alone with little to no government intervention. Therefore, we need to minimize the effects of taxes, employment, investments, and make sure that technological changes are at an efficient level.

This lets the economy to grow at a rapid pace.

Keynesian School of Thought

The word “Keynesian” comes from a macroeconomist named John Maynard Keynes.

He believes that if the economy were to be left alone, then the economy would rarely be at full employment. There needs to be active fiscal and monetary policy keep it at full employment.

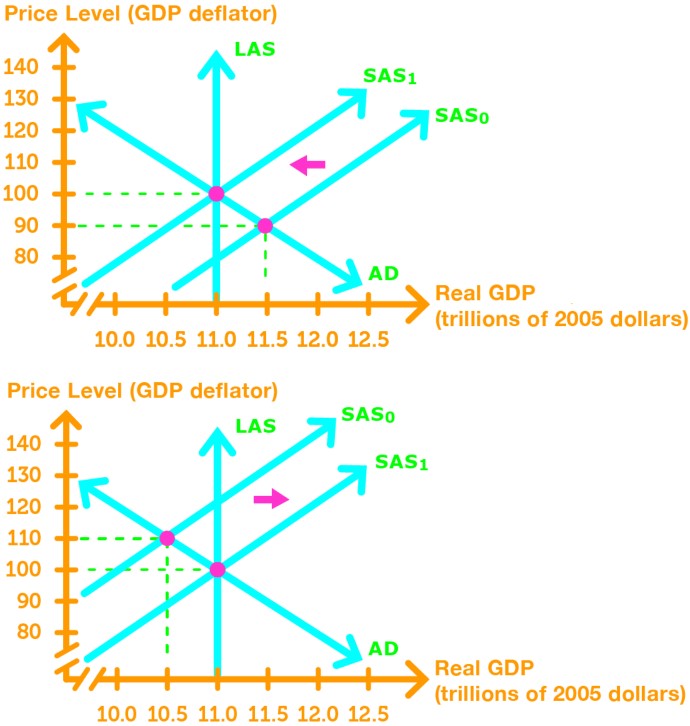

In this school of thought, future expectations impact aggregate demand.

Aggregate Demand: depending on future expectations, it can increase or decrease aggregate demand

- When there are future expectations of high profit, people/firms tend to spend more today, causing an increase in aggregate demand

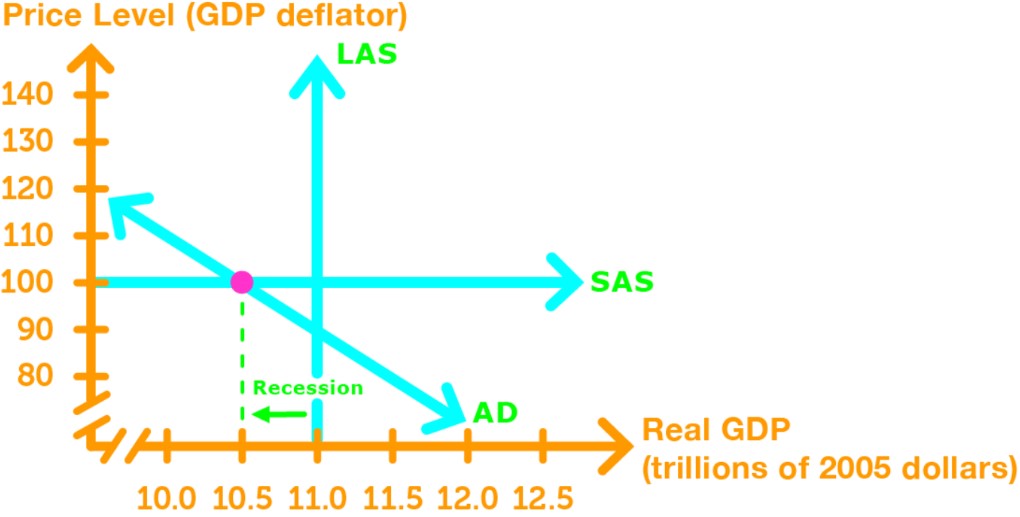

- When there are future expectations of low profit, people/firms tend to spend less today, causing a decrease in aggregate demand and causes a recession.

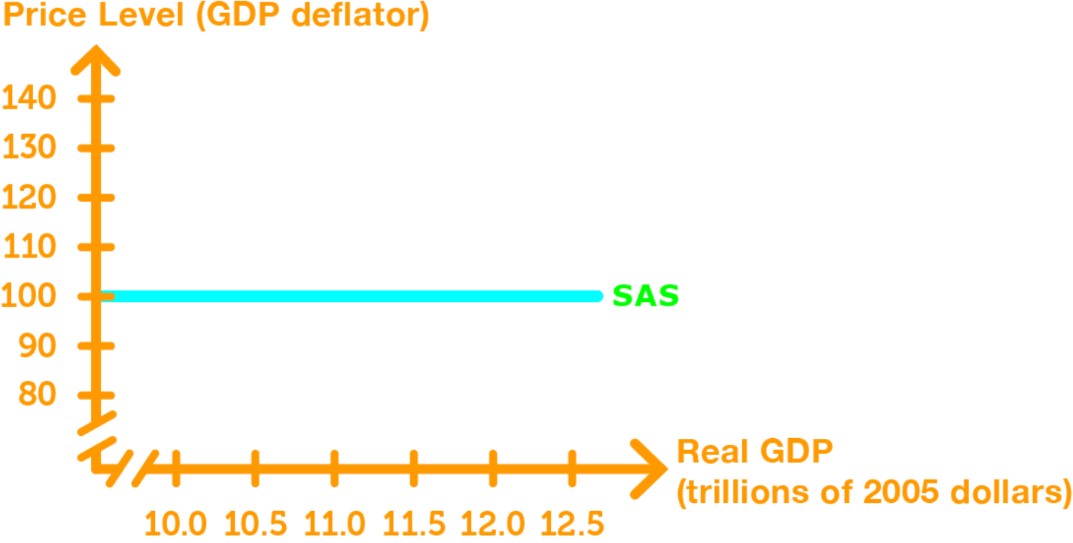

Short-Run Aggregate Supply: Money wage rate is very sticky in the short-run, causing aggregate supply curve to be really flat or even horizontal.

Due to it being horizontal, the money wage rate does not fall.

Normally in a recession, the economy would shift the upward sloping supply curve to the right so that there is no recessionary gap.

However, we cannot shift the supply curve right with a horizontal line. So, the recessionary gap remains, and we stay in recession until the government intervenes to change the aggregate demand.

Policy: the policy for Keynesian school of thought says that the government needs to use monetary or fiscal policies to actively offset changes in the aggregate demand that causes recession.

Monetarist School of Thought

The word “monetarist” comes from economists named Karl Brunner and Milton Friedman.

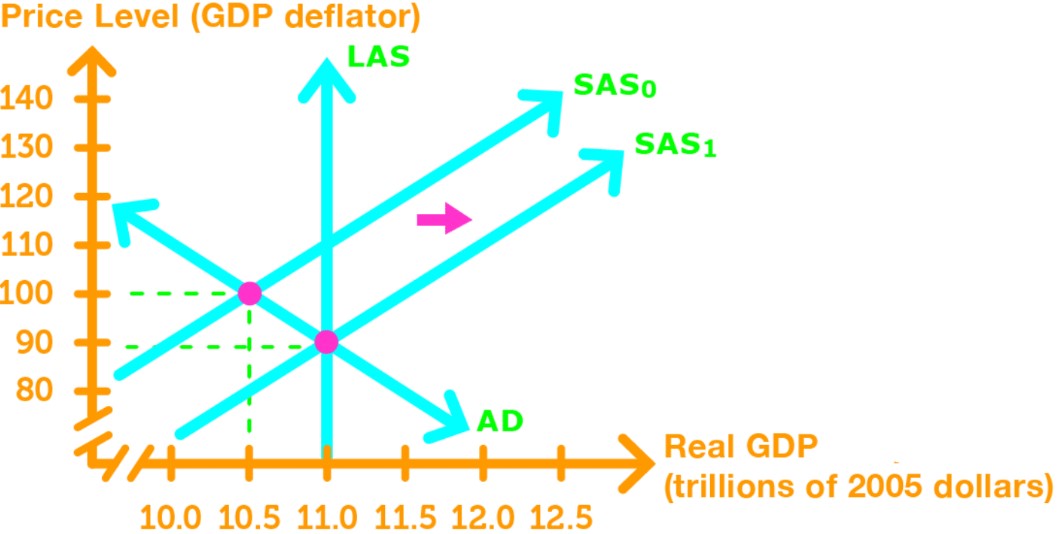

From the monetarist school of thought, they believe that the economy goes back to full employment (real GDP = potential GDP) from an automatic self-regulated system. However, this is only applicable if the monetary policy is consistent, and the growth of money is steady.

The quantity of money plays a big role in aggregate supply.

Aggregate Demand: Depending on the quantity of money, aggregate demand can shift.

- If the quantity of money grows at a rapid pace, then the aggregate demand increases.

- If the quantity of money grows at a steady pace, then aggregate demand fluctuations are minimized.

- If the quantity of money is decreased or grows at a slow pace, the aggregate demand decreases, and the economy goes to recession.

Short-run Aggregate Supply: the idea for the short-run aggregate supply works the same as the Keynesian school of thought.

Money wage rate is very sticky, so if a recession happens, then it will take a long time to reach full employment without the help of the government.

Policy: the policy is the same as the classical school of thought. As long as the quantity of money is steady, and there is little to no government intervention (taxes, etc.), then the economy will grow at a steady pace.